When help was needed most

How affluent households gave back in 2020

The extraordinary year that was 2020 — dominated by the global COVID-19 pandemic —profoundly affected every aspect of our society and our lives.

Despite the adversity, affluent1 families maintained the patterns of charitable giving that had been characteristic of better times. Nearly 90% of affluent households gave to charity in 2020, similar to previous years.

Bank of America partnered with the Indiana University Lilly Family School of Philanthropy to produce the 2021 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households, the eighth in this series of research reports, to provide insight into the charitable habits of affluent households.

Key findings

- Affluent households remained generous and consistent in their giving.

- The average amount given to charity increased from 2017.2

- The top three types of charities supported were basic needs, religion and education.

- The highest average gift amounts were given to religion, basic needs and education.

- Sustainable/impact investing participation nearly doubled compared to 2017.

- More affluent donors used giving vehicles than in 2017.

- Affluent individuals expressed confidence in the ability of businesses, governments, nonprofits and individuals to solve societal problems.

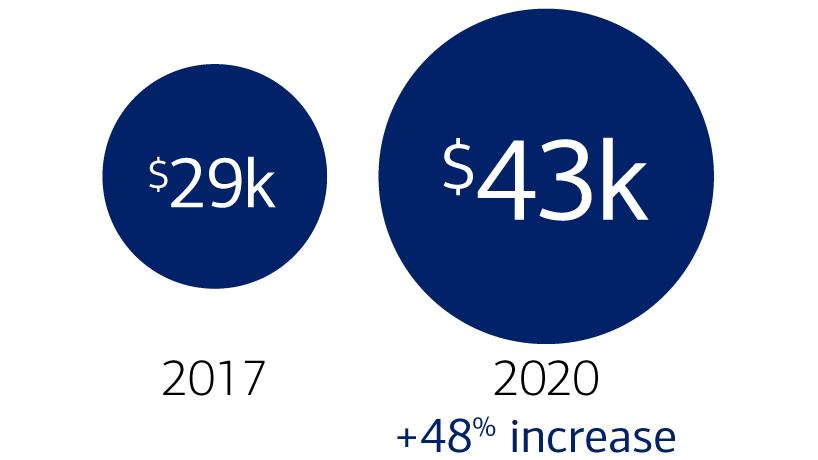

Average giving per affluent household

Charitable giving by affluent donors rose

In 2020, affluent donors not only continued to give but their giving amounts increased. Some of the increase may be attributed to affluent households’ response to the pandemic; many of these households were more easily able to shelter in place, had more cushion to protect against the economic shocks, and benefited from market gains during the second half of the year.

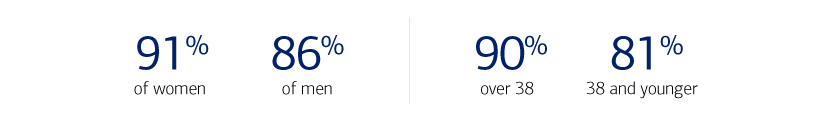

Gave to charity, among all affluent individuals

More individuals gave to support specific issues and causes

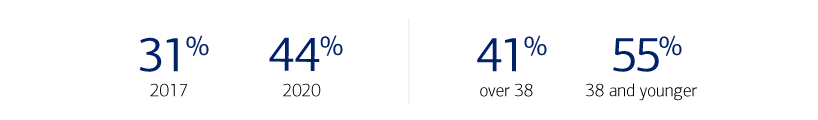

Affluent individuals’ giving decisions tend to be driven by the organization to which they’re giving or specific issues that organizations seek to address. In 2020, a plurality of affluent donors (45%) reported that organizations drove their giving decisions, a decrease from 2017’s clear majority of 54%.

In 2020, 44% of affluent donors said their giving was driven by the issues that organizations are addressing as compared to 31% in 2017, a significant jump. This was more pronounced with younger donors.

Donors gave based on issues

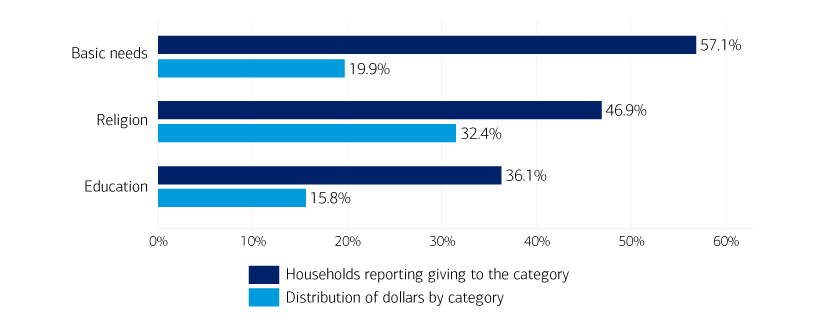

Basic needs, religious organizations and education were the causes most frequently supported by affluent households.

However, the categories affluent households reported donating to weren’t correlated with the amount donated to those categories. For example, a majority of donors (57%) reported giving to basic needs, while only 20% of their donations went to support those types of organizations.

Giving and distribution of dollars

Donors included social and racial justice causes in their giving

Increased awareness of racial injustice sparked giving for social justice and racial justice causes, with nearly a quarter of affluent individuals giving to support these causes in 2020. Among affluent households, 11.3% selected social justice as one of their top three most important causes, and 18.7% indicated they wanted to become more knowledgeable about supporting racial equity or social justice through charitable giving.

More households used giving vehicles

Affluent households have many choices about how to make charitable gifts now and for the future. In 2020, there was an increase in usage of giving vehicles.

Included a charitable provision in a will

Used a donor advised fund

The Bank of America Charitable Giſt Fund

A donor-advised fund (DAF) is a charitable giving account which enables donors to set amounts and timing for selected charities to receive grants. Learn more about the Bank of America Charitable Giſt Fund.

Impact Investing is of growing interest to affluent donors

Impact and sustainable investing aim to invest for the purpose of generating returns while supporting social, environmental or other causes.

Significantly more affluent households participated in sustainable and impact investing in 2020. (13.2%) compared to in 2017 (7.2%). Moreover, nearly 60% of donors said that their impact investing was in addition to their existing charitable giving.

Affluent households relied on digital tools for charitable giving

In 2020, many affluent households turned to digital tools in order to support causes and organizations. In addition to the 56% of donors who used a nonprofit’s website, donors also used other digital giving tools.

Used digital tools for giving

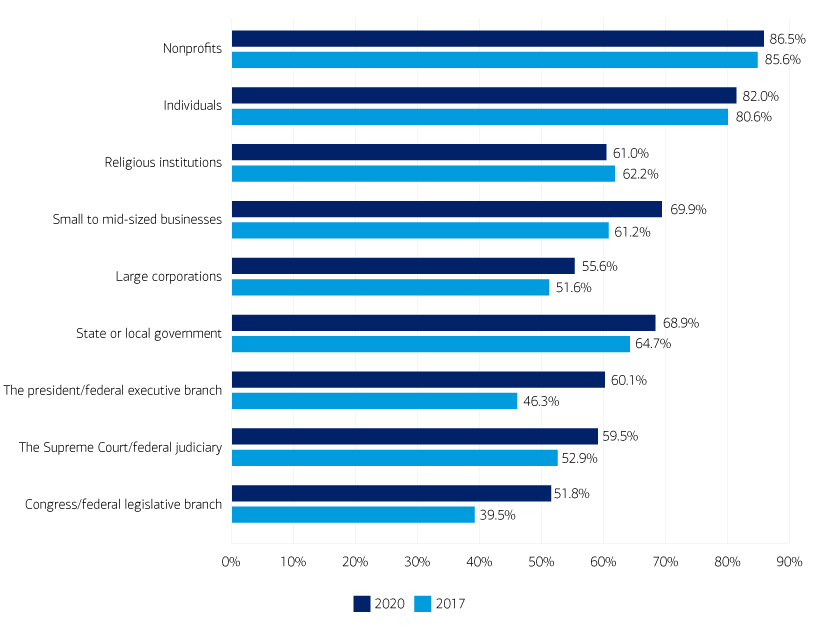

Confidence in societal institutions increased

In 2020, affluent individuals expressed significant confidence in the ability of many societal institutions to solve social problems.

Confidence in groups to solve societal or global problems

One in three households increased their giving to support needs related to the pandemic. Among those who gave, three distinct shifts in giving behaviors emerged:

Supported their local communities

90%

gave to basic needs locally

Made unrestricted giſts

70%

or more made unrestricted giſts to health care, educational, and arts and culture organizations

Found new ways to give

59%

gave directly to individuals and businesses affected by the pandemic

Conclusion

During 2020, affluent households continued the American commitment to philanthropy in good times and bad. This group’s nearly 90% participation in charitable giving — in the face of adversity — is a hallmark of donors’ generosity.

Background and methodology

This study series has set the benchmark for research on the giving practices of affluent households in the United States. The 2021 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households is based on a nationally representative random sample of 1,626 households and includes in-depth analysis based on age, gender, race and sexual identity. The households in the study have a net worth of $1 million or more (excluding the value of their primary home) and/or an annual household income of $200,000 or more. Average income and wealth levels of the participants in the study exceeded these threshold levels; the average income and wealth levels of study respondents were approximately $523,472 and $31.1 million respectively, with median income and wealth levels of $350,000 and $2 million, respectively. Respondents’ average age was 52.5 years. The survey, conducted in January 2021, reflects charitable giving in 2020.

The study captures the philanthropic motivations, priorities and strategies of affluent donors amid a challenging year. In addition, this latest study investigates donors’ contributions to affinity groups, COVID-19 pandemic relief efforts and social/racial justice in 2020. The deeper analysis by age, gender, race and sexual identity provides a more nuanced understanding of affluent donors’ behavior. Subgroup findings throughout the summary reveal statistically significant differences between the highlighted group and members of the relevant reference group, e.g., younger individuals (age 38 and younger) compared to older individuals (over 38 years of age); women compared to men; Black/African American, Asian American, or Hispanic/Latino individuals compared to White/Caucasian individuals; and LGBTQ+ individuals compared to non-LGBTQ+ individuals.

For a copy of the 2021 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households, please contact your advisor.

1 The households in the study have a net worth of $1 million or more (excluding the value of their primary home) and/or an annual household income of $200,000.

2 2017 comparisons are to the 2018 U.S. Trust® Study of High Net Worth Philanthropy, which asked about giving in 2017.

The views and opinions expressed are based on the study, are subject to change without notice at any time, and may differ from views expressed by Institutional Investments & Philanthropic Solutions (“II&PS”) or other divisions of Bank of America. This publication is designed to provide general information about ideas and strategies. It is for discussion purposes only, since the availability and effectiveness of any strategy are dependent upon your individual facts and circumstances.

Always consult with your independent attorney, tax advisor, investment manager and insurance agent for final recommendations and before changing or implementing any financial, tax or estate planning strategy. The information and data provided in this document are derived from sources believed to be reliable, but we do not guarantee that it is accurate or complete.

Sustainable and Impact Investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. Impact investing and/or ESG investing has certain risks based on the fact that ESG criteria excludes securities of certain issuers for nonfinancial reasons and therefore, investors may forgo some market opportunities and the universe of investments available will be smaller.

Institutional Investments & Philanthropic Solutions (also referred to as Philanthropic Solutions” or “II&PS”) is part of Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Trust, fiduciary, and investment management services are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A. and its agents. Brokerage services may be performed by wholly owned brokerage affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”).

MLPF&S makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of BofA Corp. MLPF&S is a registered brokerdealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.

Donor-advised fund and private foundation management are provided by Bank of America Private Bank, a division of Bank of America N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation.