One secret to creating a smarter wealth transfer plan

Holding a family meeting to share your intentions is a critical step too often skipped. Here are some tips for getting the conversation started.

SIGNING THE PAPERWORK IS THE EASY PART when you set up a wealth transfer plan for your family. What comes before that step — making often-difficult decisions about who gets what when and sharing your plans with your heirs — can be an emotional minefield.

In fact, that’s the very reason many people keep their plans under wraps even after they’ve signed all the forms. “They might be unwilling to talk about their own mortality, or worry that their children aren’t ready to manage an inheritance,” says Valerie Galinskaya, managing director and head of the Merrill Center for Family Wealth®. But the price of silence can be steep.

“If your parents seem reluctant to talk about their wealth transfer plans, try broaching the topic by talking to them about your own financial future.”

“On a practical level, not sharing your wealth transfer plans can create family quarrels later on,” notes Galinskaya. But research has also shown that a significant erosion of value can occur when assets are passed from one generation to the next — in part as a result of this lack of communication: Two-thirds of wealthy families lose their fortune by the second generation.1 “Parents can devise the perfect plan in isolation, but if their heirs aren’t prepared to receive it, they run the risk that no one’s life will be enriched,” she adds.

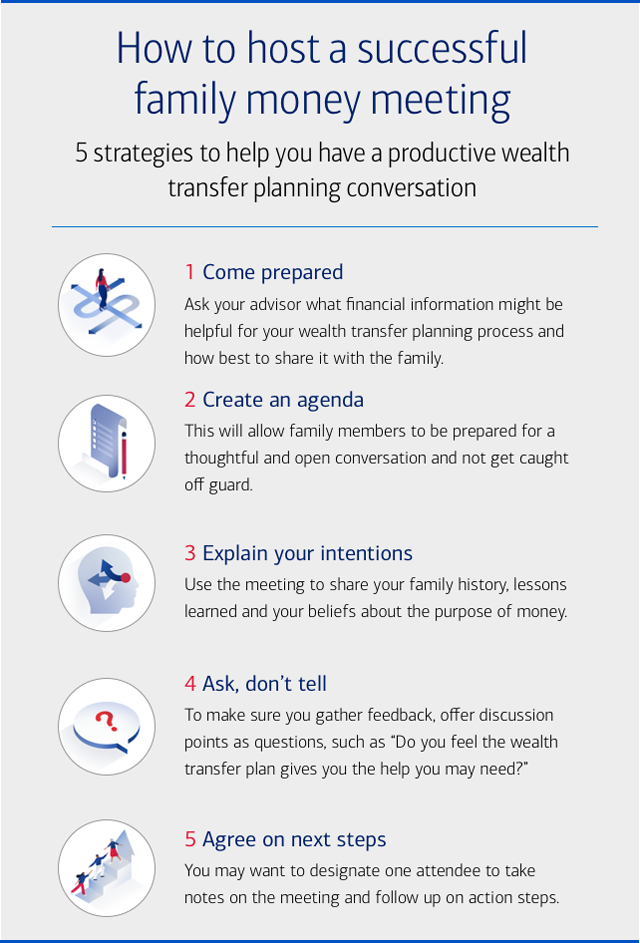

In conjunction with your estate attorney and tax professional, your financial advisor can help you think through a number of questions, such as whether to pass on your legacy, or a portion of it, while you’re still alive and how to structure your estate so that tax consequences are minimized. But when it comes to holding a family meeting to communicate your plans, few people think to ask their financial advisor to be involved. Often, having an objective advisor present to help lead the conversation and answer questions can help family members open up about their hopes, dreams, values and ambitions. Below are some tips for having a productive family meeting.

Start by thinking about what you hope to accomplish

Before you can think about involving family members in any kind of estate planning discussion, you and your spouse, if you’re married, need to come to an agreement about what you hope to leave to your kids and other family members, and what you’d like those assets to help them achieve.

As a prelude to this initial conversation, gather information about your account balances and other assets — your advisor can help. Having those numbers in mind can also be crucial later in the process, when you speak with your family members, so that they can understand how an inheritance might affect their own financial plans. Think, too, about whether you want to pass on your legacy while you’re still living or after you’re gone, in the form of a will or bequest.

“If your parents seem reluctant to talk about their wealth transfer plans, try broaching the topic by talking to them about your financial future,” suggests Galinskaya. Explain that you’ll be better able to manage your own financial plans based on realistic expectations, and point out that everyone in the family might feel more at ease knowing where to find your estate planning paperwork and which advisors or estate attorneys they should turn to in the event of your passing.

Share the ground rules for discussing your plans

For a matter as important as your estate plan, it can be a good idea to set up a series of discussions over time. For some families, such meetings can present difficulties. Siblings may not get along, and relatives might live across the country — or the ocean. However, the meetings don’t have to take place face to face; in fact, virtual meetings can be easier to schedule, and the physical distance can help remove some of the emotion, notes Galinskaya.

“Parents can’t assume that their plans will align with their children’s desires.”

Make clear that you want people to be candid but respectful, and that the idea is to forge consensus. As a rule, Galinskaya suggests, don’t talk about numbers for the first meeting or two. Instead, start by sharing your thoughts about what the assets you’ve accumulated over the years have meant to you and your family. “From there, you can talk about the impact you hope your money can have as you transfer it to the next generation,” she says. (See “How to host a successful family money meeting,” above, for more ideas.)

Finally, Galinskaya adds, discuss what principles should govern the distribution of the estate. For example, how will you handle the division of personal property that can’t be easily split? Emphasize a “we’re all in this together” approach. Wealth transfer planning is a collective responsibility requiring a collective solution, she notes.

Seek compromises that suit everyone’s goals

“Parents can’t assume that their plans will align with their children’s desires,” says Kevin Hindman, managing director and wealth strategies executive, Bank of America. He recalls the founders of one family business who believed their eldest son should inherit their company, not realizing their younger son was the one interested in running the business. “Had the parents not discussed the plan with their sons ahead of time, they could have created a situation in which one child would be saddled with an inheritance he didn’t want, while denying the other the chance to realize his dream.”

Luckily for everyone, the brothers aired their wishes in a family meeting, and the parents revised their estate plan. They passed the business on to the younger son and purchased a life insurance policy for themselves, naming the older son as the beneficiary, in order to make the inheritances equitable.

Merrill Wealth Management Advisor Mary Mullin tells the story of another couple who intended to pass on some of their legacy by paying for the education of their three children. When their daughter announced that she would rather continue working at her low-paying but emotionally satisfying job, they listened, and both sides found common ground. “The couple decided to help support her financially while she stayed at the job she loved and took college classes at night,” says Mullin. “They came to derive great joy from watching their daughter pursue work that gave her a profound sense of purpose.”

Set up an action plan

As you work together to create an wealth transfer plan designed around your family’s needs, your advisor can help with practical strategies for many complex situations. For example, say you’re considering passing on part of your estate while you’re alive, as Mullin’s clients did, but wonder whether your children are prepared to handle it. Your advisor, in conjunction with your estate attorney and tax professional, can help you implement a “test drive” approach in which you periodically give financial gifts during your heirs’ lifetime through a trust.

Then there’s the question of estate taxes. During your family meeting, your advisor can help make sure everyone understands the implications of their inheritances and can also work with your estate attorney and tax professional to see whether there might be ways to lessen their potential tax burden.

Even after all the paperwork is done, think of this as an ongoing conversation, says Mullin. “Your family meeting may be the first time you’ve broached the topic of inheritance, but chances are it won’t be the last. As your family’s needs change — through divorce, marriage or a new grandchild, for instance — you’ll want to revisit your plan over and over again.” And each time you do, it should come closer to capturing your vision for empowering the next generation.

A Private Wealth Advisor can help you get started.

1 The Williams Group, “Celebrating more than 60 years of preparing heirs,” accessed July 22, 2024.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

This material does not take into account a client’s particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy.