Progress and optimism

Financial insights from the affluent LGBTQ+ community

Putting clients first. It’s a commitment we take very seriously here at Merrill. And it requires a genuine and deep understanding of each and every client — not just as individuals, but as members of larger communities.

Today in the United States, the LGBTQ+ community comprises nearly 10% of the nation’s population1 (about 30 million people). Combined they represent roughly $1.4 trillion in annual purchasing power — an amount equal to the GDP of Spain or Australia.2 And as each generation becomes more accepting, the population of self-identified LGBTQ+ community members grows.

For years we’ve sought to better understand the experiences, motivations and goals of the greater affluent LGBTQ+ community. As we continue to track these important trends, however, we realize that much has changed over recent years — from a once-in-a-lifetime pandemic to rampant inflation, rising interest rates and an ever-shifting legal landscape. To that end, we conducted another survey in 2023 to identify emerging trends and uncover the most pressing challenges, concerns and successes.

Explore the key findings:

Financial approach, trust and barriers

LGBTQ+ individuals feel better off and are more optimistic

Despite all the challenges of the past few years, members of the LGBTQ+ community are twice as likely to feel better off in their economic outlook than the general population and markedly more optimistic about their financial future.

Much of the positive sentiment is driven by men — with women more likely to feel there’s still considerable work to be done. But this overall feeling of optimism across the broader LGBTQ+ community may reflect the increased effort that has been devoted to planning financially for their future.

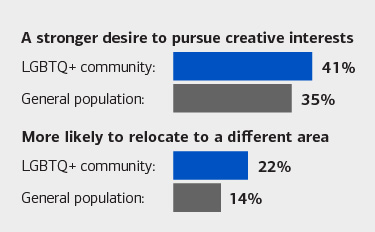

They have a stronger desire to pursue creative interests and relocate in retirement

When looking towards retirement, in addition to the universal goals of relaxing, traveling and spending time with family, members of the LGBTQ+ community express a stronger desire than the general population to pursue creative interests as well as potentially relocating to a different area of the country. Perhaps the latter is in part driven by a growing desire to find somewhere with a greater sense of community (or even moving overseas) in an effort to feel safer and more supported.

LGBTQ+ community members tend to trust their financial advisors more

Members of the LGBTQ+ community are just as likely to have a financial advisor and a financial plan. Their trust in their advisor, however, is higher than the general population. We believe this may be due in part to LGBTQ+ community members often spending considerably more time than average in seeking out an advisor who they feel will be a good fit — someone who understands them and their needs. And once they’ve developed that level of trust, they don’t want to see the bond severed.

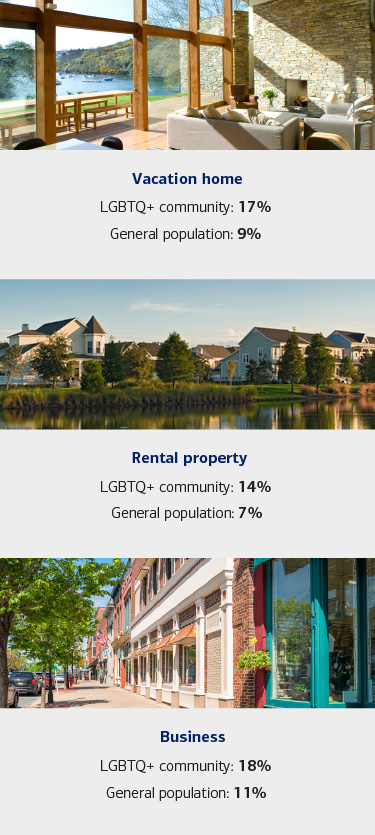

They are more likely to have non-traditional investments

While members of the LGBTQ+ community are less likely than the general population to hold traditional investments such as stocks, bonds, mutual funds and ETFs, they are measurably more likely to hold non-traditional investments including vacation homes, rental properties and a business they run themselves.

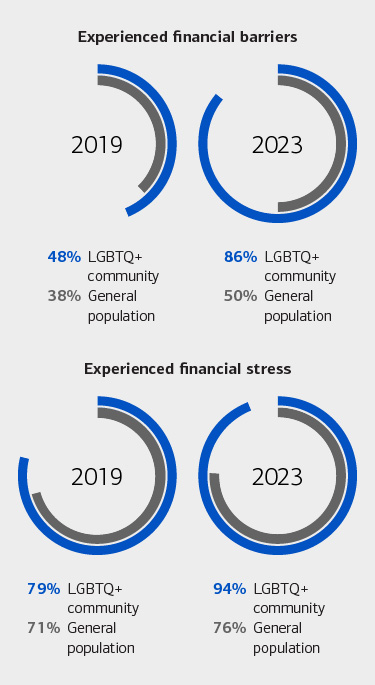

But there are lingering financial barriers and stressors

Clearly, there’s a great deal of positive financial momentum in the community. But there also remain some continuing barriers, stressors and concerns. Since 2019, the percentage of affluent LGBTQ+ community members reporting that they’ve experienced financial barriers has grown at a faster rate than the affluent general public. And there was also a more substantial increase in the percentage of affluent LGBTQ+ community members experiencing financial stress compared to the affluent general population.

Identity, family and motivators

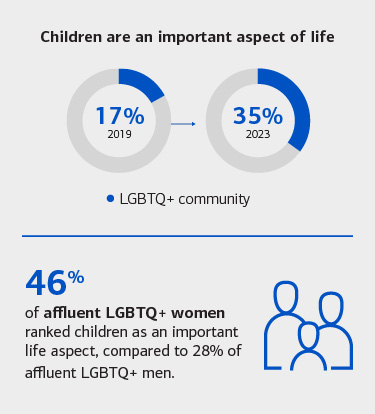

Having children in the family became even more of a priority

LGBTQ+ community members identified the top three most important aspects to life as family, themselves and children. Our 2023 survey saw a surge of the latter — with having children becoming significantly more important to LGBTQ+ respondents compared to 2019. And this was especially the case among LGBTQ+ women.

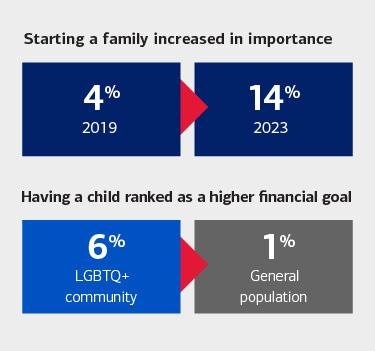

Starting a family also increased in importance

Starting a family increased in importance in 2023. Similarly, having a child ranked as a much higher financial goal for the LGBTQ+ community compared to the general population; and the gap was even wider for women (8% vs 1%) and those between the ages of 20 and 34 (12% vs 1%).

This increased focus on family may be due to the Marriage Equality Act affording the LGBTQ+ community greater stability and security — including vital access to healthcare and corporate benefits that enable families to flourish. Additionally, there may be some underlying post-pandemic reshaping and shifting of individual priorities at play.

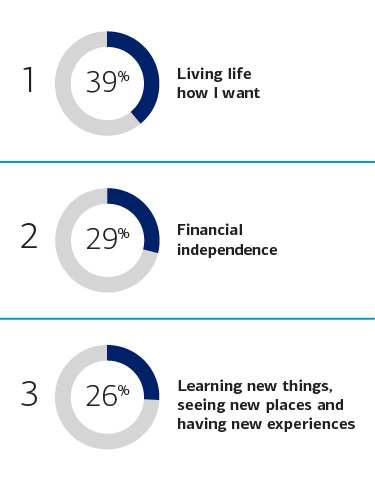

Top financial motivators revolve around personal achievement

All three top financial motivators for the LGBTQ+ community revolve around personal achievement:

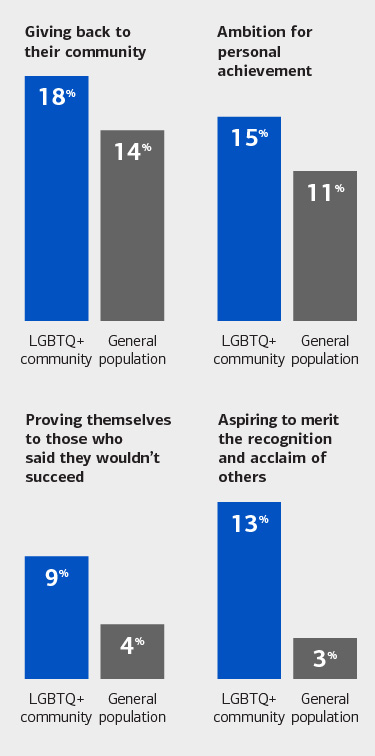

For those community members aged 55 to 75, the first two scored particularly high (62% and 51% respectively). And similar to what we saw in our 2019 survey, the LGBTQ+ community is more motivated than the general population by:

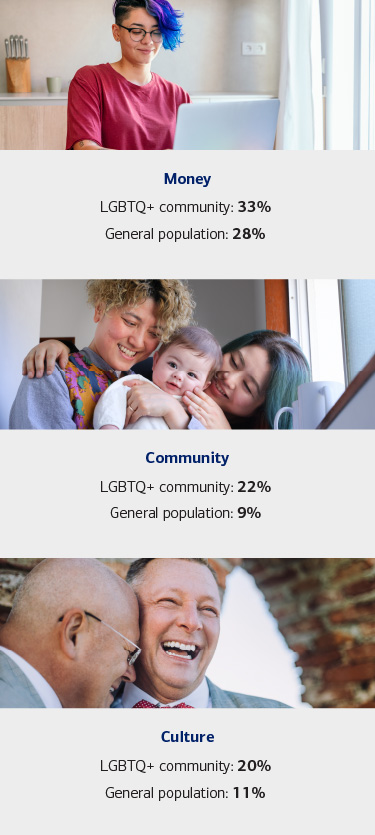

LGBTQ+ community places greater importance on money, community and culture

The next generation

LGBTQ+ community members emphasize strategies to set up next generation for success

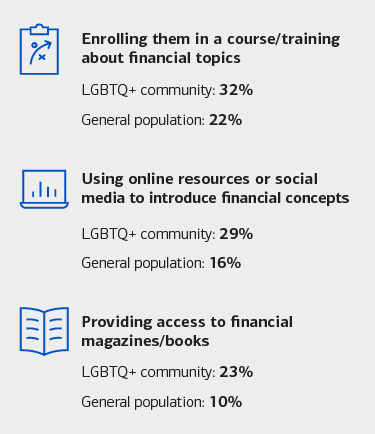

Given the increased focus on kids and family, we asked LGBTQ+ community members about strategies to help set up the next generation for financial success. Compared to the general population, they emphasized a variety of methods they would like to employ including:

Community members prioritize teaching the next generation, but face barriers

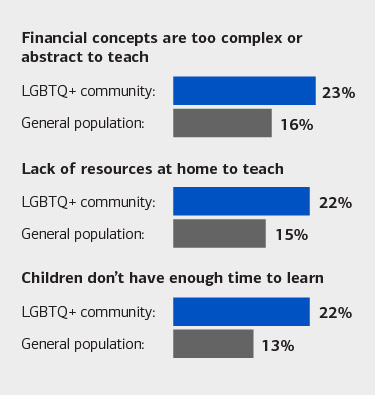

LGBTQ+ women (50%) and community members over age 55 (60%) both prioritize teaching the next generation about saving at a young age. When asked about barriers to teaching the next generation, LGBTQ+ members pointed to a lack of time, resources and their own knowledge as the biggest obstacles to setting them up for success. Compared to the general population, they worry more that financial concepts are too complex or abstract to teach, cite a lack of resources at home to teach concepts and point to their children not having enough time to learn.

Barriers to teaching the next generation

What we learned

In recent years, the affluent LGBTQ+ community has experienced a great deal of financial progress, optimism and positive momentum. Despite these many advances, a number of financial challenges and potential barriers to success appear to be on the rise. Nevertheless, the LGBTQ+ community has proven itself to be highly resilient — driven by a strong desire to live authentic lives, enjoy new experiences, and create greater acceptance and opportunities for future generations.

At Merrill, we value our many differences and are confident we grow stronger when we connect diverse backgrounds and perspectives to better meet the needs of our teammates, our clients and our communities. Words matter but actions speak louder. To that end, we remain committed to actively supporting each of our LGBTQ+ clients and proactively investing in the neighborhoods where you live and work.

If you have questions or would like additional information about this research, please talk with your Merrill Private Wealth Advisor.

About this research

Our 2023 study, conducted in conjunction with Ipsos, a global market research and consulting firm, includes the input of thousands of affluent individuals (investable assets of $100,000+) across the LGBTQ+ community. It’s part of a larger body of research devoted to furthering our understanding of the diverse experiences and financial paths of the communities in which we live and work, and exploring how our cultural, racial, gender and sexual identities influence our perspectives on wealth, money and success.

A private wealth advisor can help you get started.

1 Andrew, Scottie, “More US adults identify as LGBTQ now than at any time in the past decade, a new poll says.” CNN, February 2022.

2 The Pride Co-Op 2022 Q+ Report.

Ipsos is one of the world’s largest market research companies, present in 90 markets and employing nearly 20,000 people. Merrill or any of its affiliates are not affiliated with Ipsos. In partnership with Merrill, Ipsos conducted multiple waves of research from 2019 to 2023, employing a variety of research methodologies, starting out by interviewing Merrill stakeholders who serve and represent the diverse communities. In parallel, they synthesized and reviewed an array of publications and academic research on the topics of diversity, wealth and inclusion in financial services and beyond.

The most recent Quantitative research was conducted from February 2023 to March 2023. We surveyed 500 members of each of the three communities (affluent Black/African American, affluent Hispanic-Latino and affluent LGBTQ+) and compared them to a representative sample of the n=1000 respondents from the affluent general population.