HSAs explained: The top benefits of health savings accounts

While you might have an idea of how HSAs work, there are likely more potential advantages than you think.

You may have seen the option to open a health savings account (HSA) when you’ve signed up for health insurance at work or bought your own policy. “HSAs are intended to help you save pre-tax or tax-deductible dollars to pay for qualified medical expenses — both now and in the future — that aren’t covered by insurance,” says Jennifer Goldsmith, managing director and head of Health Benefit Solutions at Bank of America.

“An HSA has the potential for triple tax advantages — when money goes into the account, with potential growth and when it comes out.”

Paired with a qualifying high-deductible health plan (HDHP), an HSA enables you to pay for current medical expenses with pre-tax dollars — and allows you the potential to build a nest egg for the future. For example, a 40-year-old couple who max out HSA contributions each year along with taking advantage of employer contributions could have more than $600,000 set aside to cover healthcare costs by the time they turn 67.1

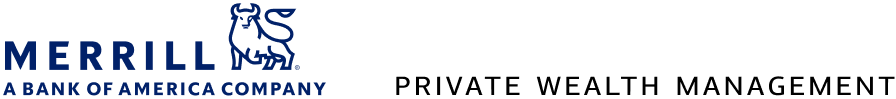

Avoiding paying federal tax on the income you earn that goes toward qualified medical expenses is just one of the attractive features of HSAs. Still, the potential advantages of opening an HSA remain a mystery to many people. Below are answers to common questions about HSAs. Mull them over as you consider ways of funding present and future healthcare costs.

Tap + for insights

A Private Wealth Advisor can help you get started.

1 HealthView Services, “The Role of Healthcare Cost Planning in Financial Wellness,” March 2023.

2 Any interest or earnings on the assets in the HSA are tax-free while held in the account. You can receive tax-free distributions from your HSA, including distributions of interest or earnings, to either pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and, if withdrawn before age 65, death or disability, may be subject to an additional 20% federal tax. You may be able to claim a tax deduction for contributions you, or someone other than your employer, makes to your HSA. We recommend you contact qualified tax or legal counsel before establishing an HSA.

Merrill, its affiliates and financial advisors do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

This material should be regarded as educational information on healthcare considerations and is not intended to provide specific healthcare advice. If you have questions regarding your particular situation, please contact your legal or tax advisor.

Please consult with your own attorney or tax advisor to understand the tax and legal consequences of establishing and maintaining an HSA plan account and how it could impact your particular situation.

While you can use your HSA to pay or be reimbursed for qualified medical expenses, if you receive distributions for other reasons, the amount you withdraw will be subject to federal income tax and may be subject to an additional 20% federal tax. Contributions made by your employer or contributions that you make on a pre-tax basis through an employer plan are subject to certain non-discrimination requirements that may limit contributions for highly compensated employees and/or key employees. Bank of America recommends you contact qualified tax or legal counsel before establishing an HSA.

Participants can receive federal income tax-free distributions from their HSA to pay or be reimbursed for qualified medical expenses they, their spouses or dependents incur after they establish the HSA. If they receive distributions for other reasons, the amount they withdraw will be subject to federal income tax and may be subject to an additional 20% federal tax. Any interest or earnings on the assets in the account are federal income tax-free if used to pay for or reimburse qualified medical expenses. Amounts contributed directly to an HSA by an employer are generally not included in taxable income. Also, if participants or someone else make after-tax contributions to their HSA the contribution may be tax deductible to the owner of the HSA.

You can take tax-free distributions for qualified medical expenses for you, your spouse and any dependents at any time, including after age 65. The Internal Revenue Service publishes a list of qualified medical expenses in Publication 502, Medical and Dental Expenses available at irs.gov. If you use distributions before age 65 for non-qualified medical expenses, those withdrawals generally are subject to ordinary federal income tax plus an additional 20 percent federal tax (although the additional 20 percent tax will not apply under certain circumstances). At age 65 and thereafter, you can withdraw funds that are not for qualified medical expenses without paying the additional 20 percent federal tax. However, you’ll still pay ordinary federal income tax on withdrawals used for non-qualified medical expenses. If you die and your spouse is your HSA beneficiary, your HSA balance can be transferred to your spouse without taxes due. Distributions from the HSA will continue to be subject to federal income tax to the extent they are not used for qualified medical expenses. If your HSA assets transfer to a beneficiary other than a spouse the account will cease to be an HSA on the date of death, and the beneficiary must report the fair market value of the HSA assets received in his or her gross income. However, the beneficiary generally can reduce their income from the assets by any qualified medical expenses of the decedent paid by the beneficiary within one year of the date of death. If no beneficiary is named or still living, HSA assets transfer according to the terms of the HSA trust or custodial account agreement, which may result in transfer to your estate.