Helping the next generation become homeowners

Today’s high prices and mortgage rates make getting a foot in the door of the housing market a challenge. Here are some ways parents and grandparents can help.

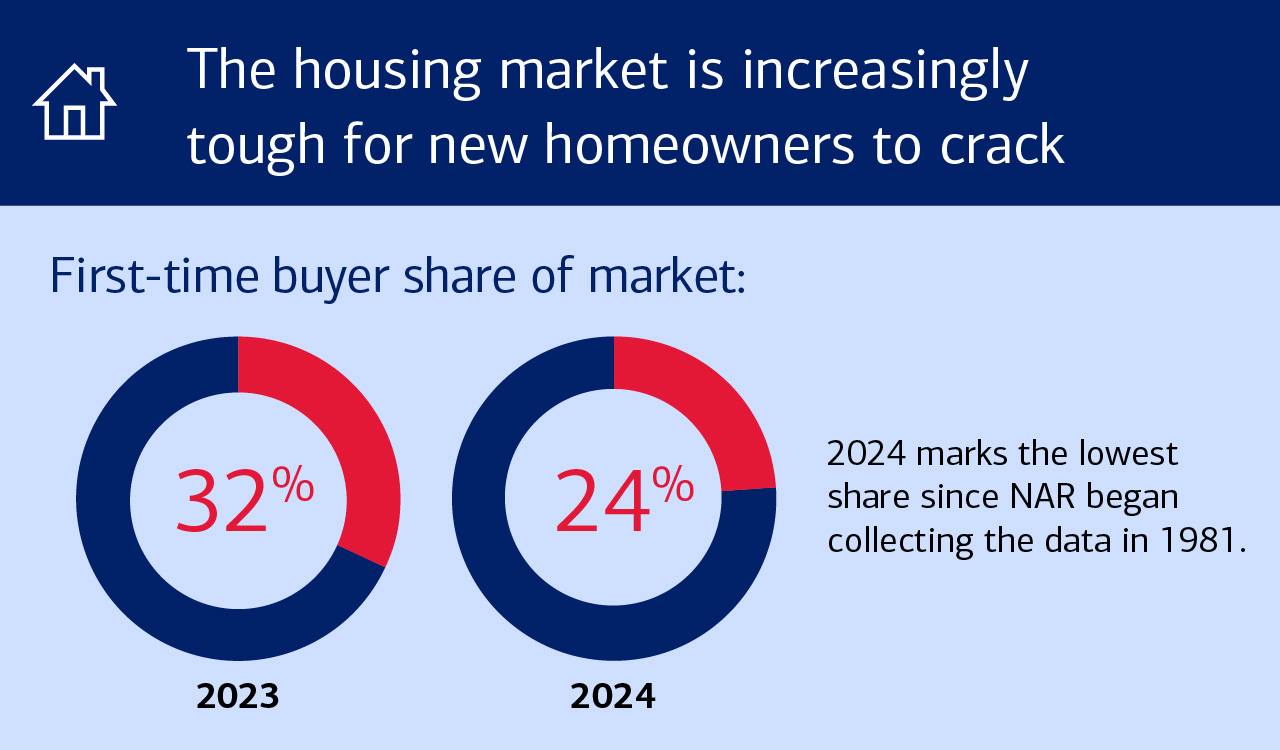

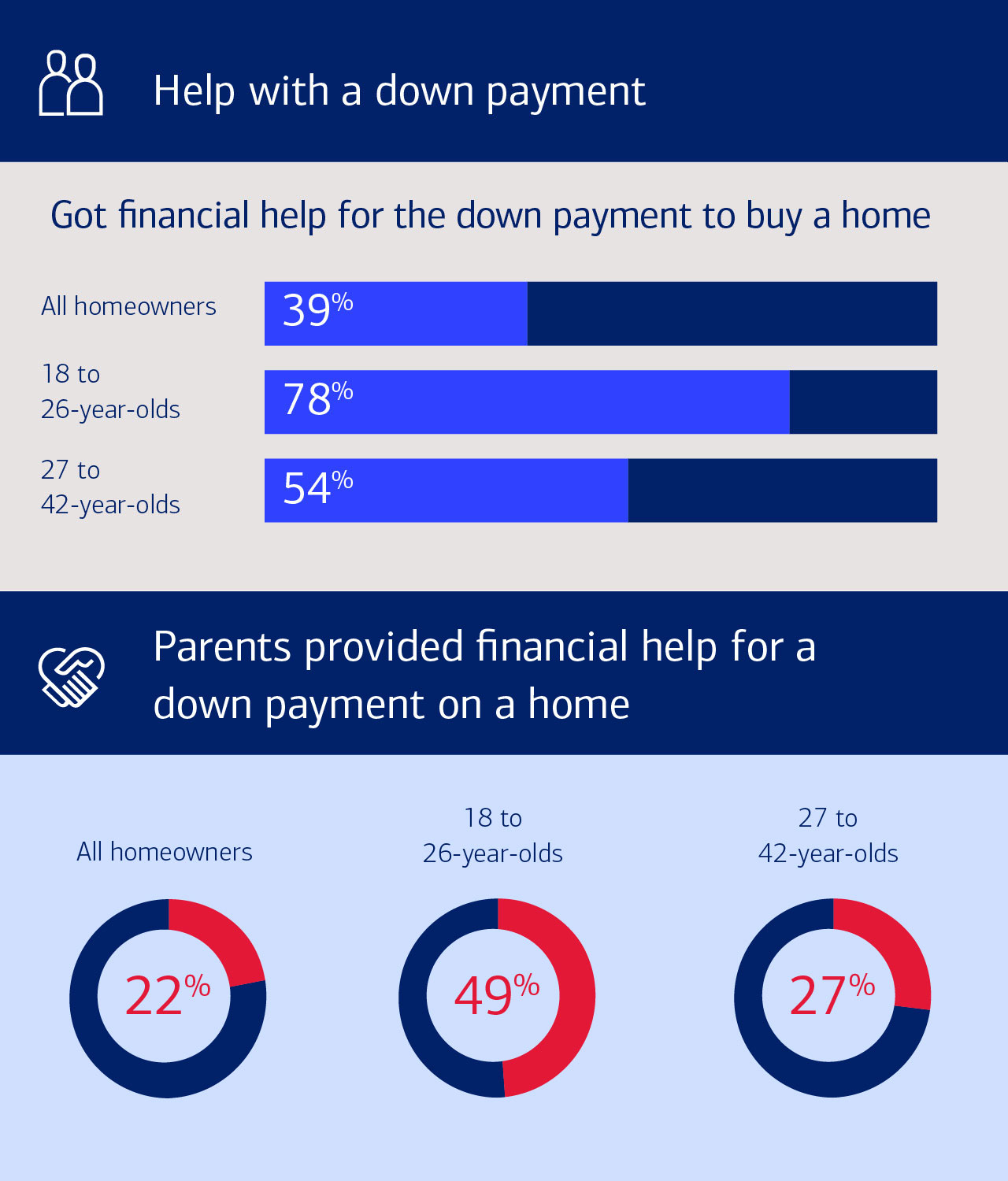

It’s a tricky situation for would-be homeowners. Elevated mortgage rates and tight inventory are propping up prices and crowding out buyers who can’t make a substantial all-cash purchase. In this market, Millennials and Gen Zers, held back by student loans and high rents, are at a particular disadvantage. That makes the role of parents — who have long been a go-to source for financial help — even more critical today. In a recent survey, almost 80% of Gen Z homeowners (ages 18 to 26) report having received some financial support for a down payment, mostly from their parents.1

Current estate tax laws make it attractive for parents and grandparents with the financial wherewithal to help young family members take ownership of their first home, notes Rocky Fittizzi, wealth strategies advisor at Bank of America Private Bank. The current lifetime gift tax exemption — $13.99 million for a single person and $27.98 million for a married couple in 2025 — is robust and will jump to $15 million per person in 2026 and will no longer expire.

If you want to make a substantial gift to facilitate the purchase of a home, you have several ways of doing so, from funding all or part of the purchase price to acting as the bank. To decide which approach may be most appropriate, you need to consider factors like taxes, estate plans, credit risks, control of the property and family dynamics. “No two children are the same, and no two situations are the same,” Fittizzi says. Here are some options worth weighing.

Source: National Association of Realtors, “NAR Profile of Home Buyers and Sellers,” November 2024.

Gift them cash to purchase the home

The most straightforward way to get young family members on the property ladder is to simply give them the cash — either for the down payment, the entire purchase price or something in between. The annual gift tax exclusion is $19,000 per donee in 2025, or $38,000 per donee if you and your spouse split the gift. Any amount below those limits won’t count against your lifetime limit. A gift above that amount would use your lifetime exemption, but not result in a payment of gift taxes.

With any estate planning strategy like this, you’ll want to consider how to help one child or grandchild in a way that’s fair to other siblings or cousins. “Kids may be resentful if their home costs less than a sibling’s,” Fittizzi says. “It is worth having the conversation on equalization if members of the family believe this could be an issue and cause long-term disharmony.”

What to watch for: If the home becomes a marital asset of the child, it could be an issue in a divorce. Even when you have confidence a marriage will last, a trust strategy (see below) could help alleviate any lingering concerns.

Pledge your eligible assets

With the Parent Power® program2 you can pledge eligible Merrill securities to help fund a family member’s3 down payment on their new primary residence. This can be done without co-signing on your child’s loan, or disrupting your investment strategy and also helps your family member avoid private mortgage insurance. Your assets would remain fully invested, allowing you to continue to buy, sell or trade eligible securities held in the pledge account.

Buy or finance the home through a trust

Having a new or existing trust purchase the home gives the trustee control of the property and offers a measure of protection in the case of divorce or other claims. At the same time, it adds greater complexity. While there are many ways to structure a purchase this way, the most common is for a parent or grandparent to set up an irrevocable trust for the benefit of the child and then make a gift to the trust. The trust would buy the home and allow the child to live there rent-free, establishing terms for how ongoing costs like taxes and maintenance will be covered.

With an existing trust that benefits a child, you might also consider having the trust lend the child money to buy the home, which can allow for flexible loan terms. One advantage to this is that the child can build equity over time and eventually own the home outright.

What to watch for: An approach this complex requires careful planning with your advisor and a tax professional. One downside for the child to consider is that they are not building up equity when the trust owns the home, which could work to their disadvantage over time.

Source: Lendingtree.com, “Nearly 80% of Gen Z Homeowners Had Down Payment Help — Mostly From Family,” October 2023.

Buy the home and rent it to your child

This approach makes the most sense if your child is going to use the home only for a few years — perhaps for college — and you expect to eventually convert it to a vacation home or income-producing investment property.

What to watch for: The rent you collect from your child is taxable income, and this strategy may run counter to your larger financial goals. “If kids are paying rent to their parents, that goes back into an estate that the parents may be trying to dilute,” Fittizzi says.

Act as the banker

With stubbornly high home prices and elevated interest rates, parents or grandparents may want to function as the bank. When you lend your children the money to buy a home directly, they can enjoy easier access to credit as well as more favorable and flexible loan terms — including an interest rate lower than that of the typical mortgage.

To make the deal even better, you can periodically gift at least a portion of the interest. “Basically, you set up an interest-bearing promissory note, then at the end of the year, you can consider forgiving the interest to be paid up to the annual gift tax exclusion threshold,” Fittizzi says. However, that interest income will still represent taxable income.

What to watch for: So that the IRS won’t consider the initial intra-family loan a gift, you must adhere to certain guidelines, including charging mandated minimum interest rates. Recently that rate has been about 4% to 5%, depending on the length of the loan. Given the current high rates on savings and treasury yields, making an intra-family loan isn’t the win-win it once was, it’s more of a break-even. You may be getting pretty good returns on cash and treasury securities, so lending to family members may present a credit risk rather than a return risk.

Another option is to borrow against your portfolio to raise funds for your child or grandchild, which lets you leave the stocks and bonds you’re using as collateral invested in the markets. Keep in mind that rates on these loans have risen along with all interest rates, so borrowing costs could exceed your potential investment returns. “Now the rate is much higher, around 8%, like a mortgage,” Fittizzi says. “But at the same time, it might be the right option for some families.”

Team up on the mortgage

Co-signing or guaranteeing the mortgage is another way you can help a child or grandchild qualify for a better rate or larger loan, and parents are allowed to co-sign on mortgages with Bank of America. You agree to the terms of the mortgage but owe nothing (and own nothing). This can be a learning experience for the child. “You’re building in a security net if you’re co-signing, but at the same time you’re not letting your child off the hook,” Fittizzi says. “It’s part of the educational process of paying bills.”

What to watch for: Co-signing makes you responsible for the debt. If the child can’t keep up payments, you are putting your own credit at risk and may have to pony up for mortgage payments. In some instances, there could even be gift tax implications for your willingness to co-sign or guarantee the mortgage.

No matter what strategy you adopt, you should revisit your plan annually. “If interest rates drop in the years ahead, we are having a conversation about refinancing,” Fittizzi says. “It’s important to note that this is an ongoing conversation, not a set-it-and-forget-it situation.”

Merrill advisors can help you evaluate how these and other strategies can fit into your financial plans. Then if appropriate, bring in their Bank of America loan specialists to identify the right solution for your needs.

A Private Wealth Advisor can help you get started.

1Lendingtree.com, “Nearly 80% of Gen Z Homeowners Had Down Payment Help — Mostly From Family,” October 2023.

2Parent Power® program requires the pledge of eligible diverse securities owned by an individual and maintained in a Merrill Lynch, Pierce, Fenner & Smith Incorporated (Member, Securities Investor Protection Corporation [SIPC]) brokerage account. This program may not be suitable for everyone, and a default on your mortgage could result in the loss of both your home and the securities pledged. Should the value of the securities pledged as collateral decrease below a certain level (as specified within the loan documents), the deposit of additional assets and/or liquidation of assets may be required. Merrill may liquidate some or all of the securities in the account without contacting you. You are not entitled to an extension of time to meet a collateral call or choose which securities in your account are sold to meet the collateral call. Liquidation may result in adverse tax consequences. Mortgage interest may not be deductible if tax-exempt obligations are pledged as additional collateral; consult your tax advisor. Trading within the brokerage account for the 100% financing programs is subject to restrictions.

3The Parent Power® program is not limited to parents who want to help their children with home financing. The applicant’s parent, child, dependent or any other individual related to the applicant by blood, marriage, adoption or legal guardianship or from a domestic partner, fiancé or fiancée can pledge securities.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions