Selecting the appropriate charitable vehicle

Example client profile

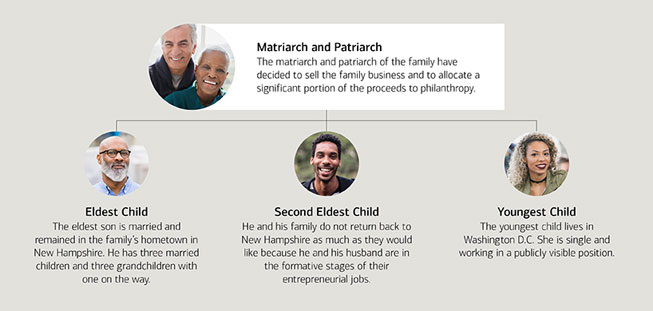

A Bank of America Private Bank client living in New England started a family foundation with the mission of supporting local youth organizations. Over time, the family grew to include multiple generations living across the United States. The matriarch and patriarch of the family decided to sell the family business and allocate a significant portion of the proceeds to philanthropy. In preparation for the sale they engaged Bank of America and the Philanthropic team to help the family strategize their philanthropic options and plan the family’s future giving. They sought the team's assistance to present various charitable vehicles to the extended family.

Action steps taken

To help design a philanthropy strategy for the whole family, the team:

- Presented an educational overview of the operational, governance and grantmaking requirements of a family foundation as compared to a donor-advised fund. Please keep in mind, contributions to DAFs are irrevocable.

- Facilitated a discussion about how different giving vehicles may help each family member pursue their own philanthropic vision;

- Recommended separate meetings with each family branch to discuss establishing its own strategy and philanthropic vehicles – be it a foundation or a donor-advised fund and/or remaining involved with the family’s foundation.

Eldest Child: Became more actively involved in the existing family foundation

- He’s married with three grandchildren and remained in New Hampshire. He is actively involved with the existing foundation.

Action steps taken

- Facilitated a family meeting to discuss the history and purpose of the existing foundation and his family’s individual and collective philanthropic values and interests. Presented Bank of America's Raising Philanthropic Kids1 workshop with ways to engage each child in philanthropy.

- Researched giving opportunities to youth organizations, aligned with the family foundation’s mission and strategy.

Impact

- Decision: Became more actively involved in the existing foundation.

- Family members affirmed their commitment to youth organizations and preserved the founders’ intent to foster family unity, continuity and a lasting legacy.

- Established a junior board, empowering the next generation to have some control in the mission and governance of the foundation.

- The grandparents and parents are pleased with the younger generation’s involvement in the family foundation’s work, giving them confidence in the legacy of the family foundation.

Second Eldest Child: Stepped down from the existing family foundation and opened a new donor-advised fund

- He’s married with one young child and lives in Seattle. He and his husband weren’t able to travel home as much as they would like and felt they couldn’t engage deeply with the family foundation.

Action steps taken

- Facilitated a discussion regarding their obligations to the foundation.

- Listened and learned about the couples values and priorities. The couple decided to focus their giving in Seattle.

- Worked with the couple’s tax professional to integrate their philanthropy with their overarching wealth structure, particularly considering their share of the upcoming sale of the family business and diversification of their portfolio given the concentration of highly-appreciated stock.

- Addressed potential tax implications (e.g., cash, appreciated stock, real estate, etc.) to a donor-advised fund and how the donation of appreciated stock, in particular, may be more beneficial than if given to a private foundation.

Impact

- Decision: Opened a donor-advised fund with the Bank of America Charitable Gift Fund and stepped down from the existing family foundation.

- The donor-advised fund has no annual distribution requirement, giving the couple time to consider their philanthropic strategy and goals over the coming years.

- Contributing cash and highly appreciated stock to the fund helped the couple maximize their tax benefit and helped address their portfolio construction concerns. Please keep in mind, contributions to DAFs are irrevocable.

- Site visits established to learn more about nonprofits where the couple might have the greatest impact with their giving.

Youngest Child: Stayed involved with the existing family foundation and opened a donor-advised fund

- She lives in Washington D.C., is single and works in public relations.

Action steps taken

- Review of her philanthropic goals confirmed her intent to remain active with the family foundation to stay connected with her family, maintain her ties to New England area and contribute to the foundation’s impact.

- Helped her set her philanthropic priorities and recognize they were outside the scope of the foundation.

- Identified local conferences, workshops and webinars to help expand her networks and inform her interests — including both the youth development focus of the family foundation and her own areas of interest.

- Reviewed the characteristics of a donor-advised fund which allow anonymous gifts, unlike her family’s private foundation.

Impact

- Decision: Opened a donor-advised fund with the Bank of America Charitable Gift Fund, allowing her to establish her own giving identity, contribute to causes outside the mission of her family’s foundation and have her giving remain anonymous.

- Remain active in the family foundation and help identify programs that more closely align with its mission and strategy, and connect with other foundations for future collaboration.

The case study presented is hypothetical and does not reflect specific strategies we may have developed for actual clients. It is for illustrative purposes only and intended to demonstrate the capabilities of Bank of America Private Bank and/or Bank of America. It is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Results will vary, and no suggestion is made about how any specific solution or strategy performed in reality. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.

Contact us at 888-703-3436 or email us.

A Private Wealth Advisor can help you get started.

1 Offered by Bank of America Private Bank Philanthropic Strategists. Services are available to clients with assets under management starting at $10 million.

The case studies presented are hypothetical and do not reflect specific strategies developed for actual clients. They are for illustrative purposes only and intended to demonstrate the capabilities of Merrill and/or Bank of America. They are not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Results will vary, and no suggestion is made about how any specific solution or strategy performed in reality.

Donor-advised fund and private foundation management are provided by Bank of America Private Bank, a division of Bank of America N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation.

Institutional Investments & Philanthropic Solutions (also referred to as "Philanthropic Solutions" or "II&PS") is part of Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC, and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Trust, fiduciary, and investment management services are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A. Brokerage services may be performed by wholly owned brokerage affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill").

MLPF&S makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of BofA Corp. MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.