Do’s and don’ts of investing an inheritance

From tax considerations to asset allocation and more, there are many factors to consider before merging inherited assets into your portfolio. These tips can help.

INHERITING A WINDFALL, however large or small, comes with so many questions. Can I now afford to take on more risk? Retire early? Give more to charity? Thanks to a historic transfer of $72 trillion from baby boomers to Gen X, millennials and Gen Z over the next 20 years,1 more and more people are asking these questions. Underlying them all is this one: How do you marry the assets you inherit into your own portfolio to help you better pursue your goals?

“An inheritance can open opportunities to pursue new goals, eliminate debts, rethink retirement plans, step up helping others and more,” says Joe Curtin, head of Portfolio Management for the Chief Investment Office (CIO), Merrill and Bank of America Private Bank. “But along with these positives, a sudden change in your financial situation requires careful planning.” The following insights could help.

Tip: Schedule time with your financial advisor to assess how your goals, asset allocation, timelines and risk tolerance might change before you incorporate inherited assets into your own investing decisions.

Do take your time making decisions

Do take your time making decisions

Whether an inheritance is expected or comes as a surprise, your mind may turn first to things you can buy, relatives you can help or investments to leap into. “Take a step back,” Curtin advises. Give yourself time to process how this newfound wealth may affect you financially and emotionally. “The biggest mistakes often come from hasty decisions,” he adds.

Don’t simply mash two portfolios together

Don’t simply mash two portfolios together

However well suited to its original owner, an inherited portfolio may not fit your needs. Simply folding your parents’ or grandparents’ investments into your own portfolio could throw your asset allocation out of balance. If retirement is years away and you inherit a bond-heavy portfolio, for instance, you may need to sell bonds and buy stocks to reestablish the ratio that’s right for you. Another risk: If you inherit assets similar to those you already own, you could find yourself overconcentrated in certain sectors of the market, Curtin cautions.

Do put your cash to work

Do put your cash to work

Tip: If investing your inheritance all at once makes you uncomfortable, consider dollar-cost averaging — investing small, preset amounts at regular intervals.

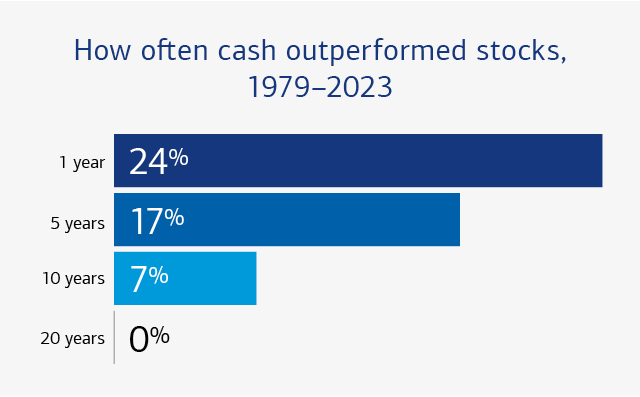

If you’ve inherited cash — or made a profit on the sale of the family home you’ve inherited, or find that you’re required to take a distribution from an inherited IRA — don’t sit on the proceeds. Even with today’s high yields starting to moderate, you can earn a steady return while you consider how to deploy the funds.

Note: Total returns for all rolling time periods between 1979 to 2023. Source: Chief Investment Office, Merrill and Bank of America Private Bank, “Steer the Course of Your Financial Future: A Guide for Long-term Investors,” March 2024.

Tip: Take some time to research new market opportunities. Could investing in them provide potential long-term growth opportunities?

Don’t be afraid to rethink your risk tolerance

Don’t be afraid to rethink your risk tolerance

An inheritance could give you the freedom to invest more aggressively for aspirational goals such as a vacation home. Or, if you’ve suddenly got most of what you need for retirement, you might opt to take fewer risks with your investments. Now is the time to take a good hard look at your goals, timelines and approach to risk.

Do consider new ways to diversify

Do consider new ways to diversify

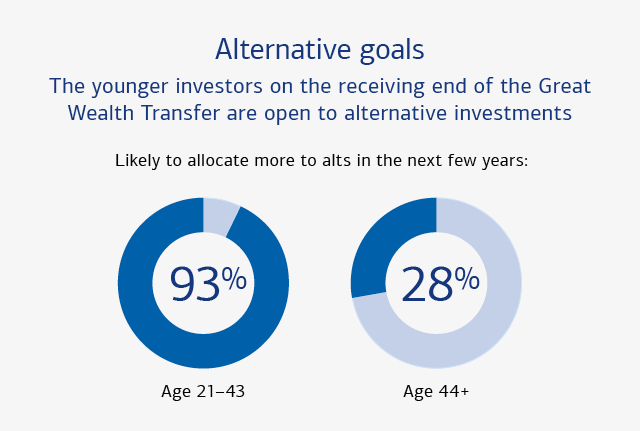

With more total assets, you may qualify for alternative investments such as private equity, hedge funds, real estate investments or direct investments in private businesses. “Alternatives offer the potential for enhanced returns and reduced risk that could be hard to find in public markets,” Curtin says. Just be aware that alternative investments come with a very high degree of risk, are only appropriate for certain investors and tend to be less liquid than publicly traded stocks. It’s also important to carefully research the investment managers. An advisor can help you decide which alternative investments may fit your needs.

Source: 2024 Bank of America Private Bank Study of Wealthy Americans

Don’t overlook tax-planning strategies

Don’t overlook tax-planning strategies

Tip: A couple of other tax-efficient strategies an inheritance may allow you to employ: putting aside more money in a 529 educational savings plan for a family member and bolstering contributions to your tax-deferred retirement plan.

As you begin to incorporate your inherited assets into your investment strategy, consider another important tax benefit of inherited wealth: the step-up in cost basis. No matter what the original owner paid for an investment, as an heir your basis for tax purposes is the value on the date of death, says the National Wealth Strategies team for the Chief Investment Office, Merrill and Bank of America Private Bank. By selling the investment soon after you inherit it, you will face little or no capital gains taxes, giving you an opportunity to adjust your portfolio in a tax-efficient manner.

“If you had been planning to sell a position you already held to pursue another opportunity,” adds Curtin, “selling the inherited stock instead could mean you wouldn’t face a tax bill.” Conversely, if you have charitable goals, you might donate stocks from your existing portfolio with a higher capital gains exposure and hold onto the inherited stocks to maintain the benefit of the step-up in basis. Your advisor and tax specialist can help you review these and other tax strategies.

Do pay attention to the rules for inherited IRAs

Do pay attention to the rules for inherited IRAs

Tip: Taking no more than your RMD from an inherited IRA each year could result in a large mandatory withdrawal and outsized tax bill in year 10.

If your inheritance includes an IRA or other tax-deferred account, you generally have 10 years to withdraw the assets unless an exception applies. While, in many cases, you’ll be subject to annual required minimum distributions (RMDs), “you have a lot of flexibility on how much to withdraw each year,” Curtin says. If your income varies from year to year, consider evening out your tax bill by taking more out of the inherited IRA when your other income is lower.

Don’t go it alone

Don’t go it alone

From can’t-miss stock tips to offers to get in on the ground floor of the next big business success, an inheritance often brings lots of unsolicited advice. Even if well-intentioned, these tips could result in substantial losses or concentrating too much risk in one area, Curtin says. If you don’t already work with a financial advisor, now may be the time to start. They can review your finances, clarify your goals, assess risks and create an investment strategy to help you make the best use of your inherited assets. “You’ll go through this journey together.”

A Private Wealth Advisor can help you get started.

1 Cerulli Associates, “The Cerulli Report: U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2021.”

Important disclosures

Investing involves risk including possible loss of principal. Past performance is no guarantee of future results.

Merrill, its affiliates, and financial advisors do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”).

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration.

Keep in mind that dollar cost averaging cannot guarantee a profit or prevent a loss. Since such an investment plan involves continual investment in securities regardless of fluctuating price levels, you should consider your willingness to continue purchasing during periods of high or low price levels.