The financial reality of today’s young athletes

New research reveals a generation of young athletes facing unprecedented financial complexities

Today's young athletes are defying stereotypes about professional sports figures and money management. New Merrill research reveals a generation of financially savvy young athletes who prioritize saving and investing while navigating unprecedented financial complexity.

The study of 159 high-potential U.S. athletes in their late teens and early 20s uncovers where thoughtful decision-making meets unique challenges. With 74% expecting $25,000 or more from name, image and likeness (NIL) deals, sponsorships and related opportunities in 2025, these athletes face financial challenges that require specialized guidance.

Four key insights emerge from this study

Smart financial priorities drive spending decisions

Today's young sports professionals demonstrate remarkable financial discipline. Athletes allocate 36% of their sports earnings to saving and investing — their top financial priority — while dedicating only 6% to luxury items.

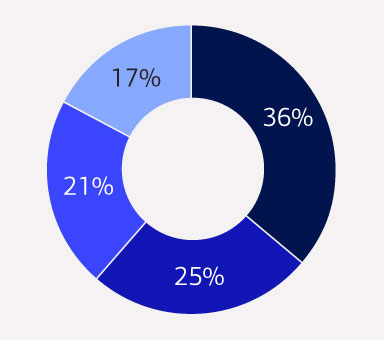

Projected spending allocation

36% goes to saving and investing — their top financial priority

25% supports personal wants — with only 6% going to luxury items

21% supports others — including family and charitable giving

17% covers basic needs — essential daily expenses

Most athletes have experience with savings accounts (98%), checking accounts (92%) and credit cards (69%), with approximately one-third (31%) maintaining investment accounts.

NIL opportunities create both income and complexity

NIL opportunities have transformed the financial landscape for college athletes, creating substantial earning potential and complex challenges.

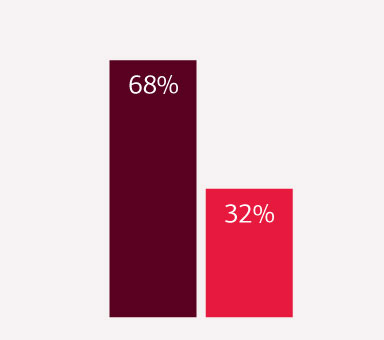

NIL demonstrates significant financial impact

68% have NIL deals or opportunities in progress

32% earned $10,000+ from NIL deals in 2024

Despite widespread participation, 61% report struggling with NIL navigation. The challenges include worrying about exploitation (38%), fearing scams or unethical deals (36%) and finding contracts complex and confusing (36%).

Athletes with NIL deals show greater interest in learning investment strategies.

A confidence-reality gap creates risk and opportunity

A disconnect emerges between athletes' confidence in their financial knowledge and the complex realities they face. While 80% rate their financial literacy as "good" or "excellent," 32% feel financially insecure, 21% report being stressed about finances, and only 48% maintain a budget with just 19% sticking to it consistently.

Athletes currently seek financial guidance from parents and guardians, online research and friends and teammates. These sources may fall short when addressing unique athlete challenges like NIL negotiations and industry-specific tax considerations where they need specialized legal and tax professional guidance.

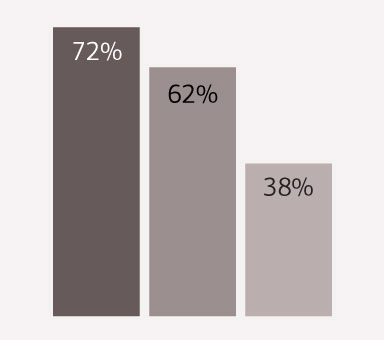

Resources used for information on managing finances

Parents and guardians (72%)

Online research (62%)

Friends and teammates (38%)

Interest in professional guidance is overwhelming

The research reveals remarkable openness to professional guidance, with 88% expressing interest in working with financial advisors. Currently, only 8% work with advisors.

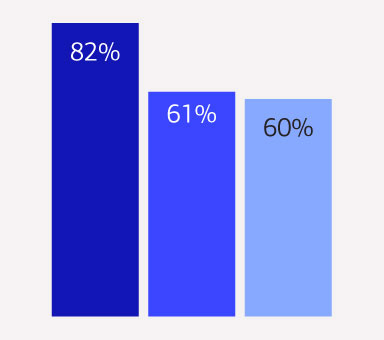

Athletes want to learn about:

Investing (82%) — moving beyond basic saving to wealth-building strategies

Tax planning (61%) — managing NIL income tax implications

Building credit (60%) — preparing for major purchases

Key concerns motivate athletes to seek professional guidance: 74% wish they had saved more money over the past year, 40% fear losing money through bad decisions and 29% worry about not earning enough to support their goals.

Building on strong foundations

Today's young athletes represent a financially responsible generation seeking help to make smart choices while facing unprecedented opportunities and complexities that require specialized guidance. Athletic careers can involve compressed earning timelines and significant income growth at young ages, making early financial decisions crucial. Recognizing this and seeking professional guidance early may help position young athletes to maximize both immediate opportunities and long-term wealth building.

To explore how specialized professional guidance can help athletes build strategies designed to manage NIL income, build wealth and make an impact through college, pro career and beyond, read the full research report and connect with a Merrill Sports & Entertainment Advisor to discuss your unique situation and goals.

Connect with a Merrill Sports & Entertainment Advisor today.

How we can help

Connect with a Sports & Entertainment Advisor

This analysis is based on research conducted among 159 high-potential athletes across the United States in 2025. High-potential athletes were defined as those age 18+ with significant earning potential, including athletes with existing or pending NIL deals of $10,000 or more, those competing at professional levels or offered professional contracts, athletes representing their country in international competition, those competing in top conferences for their sport or those expecting to pursue professional athletics.

The study participants represented diverse sports including basketball (18%), football (14%), baseball (11%), soccer (9%) and various other competitive athletics. Ages ranged from 18-24, with 81% between ages 18-21. The study examined financial behaviors, NIL participation, advisor relationships and financial planning priorities, providing comprehensive insights into this unique demographic’s financial needs and preferences.